Global Capability Centres (GCCs) are the key drivers in the Banking and Financial Services sector. India, alone, hosts 1,700 – 1,900 GCCs, that generate USD 64.6 billion and employ 1.9 million in 2024. By 2030, forecasts estimate 2,100–2,200 GCCs, 2.5–2.8 million employees, and revenues reaching between USD 99 –105 billion.

In BFSI, the GCC market, was valued at USD 40–41 billion in 2023, and is projected to triple to USD 125–135 billion by 2032, growing at a 12–13% CAGR. GCCs are transforming into engines of automation, compliance, and innovation, driving sustainable, scalable, and resilient financial services.

The Value of Global Capability Centres in BFSI

GCCs have evolved beyond cost arbitrage hubs, also known as Centres of Excellence (CoE). Today, these GCCs as strategic growth engines, enabling the BFSI sector to achieve:

- Process Efficiency: Streamlined workflows through Business Process Management (BPM) frameworks.

- Regulatory Compliance: Built-in governance aligned to GDPR, HIPAA, ISO, and SOC 2 Type 2 standards.

- Scalable Operations: Flexible models to expand services across geographies and time zones.

- Technology Integration: Automation, RPA, and AI-enabled solutions that reduce errors and improve turnaround time.

- Data Security: Secure handling of sensitive financial data, anchored in the CIA triad (Confidentiality, Integrity, Availability).

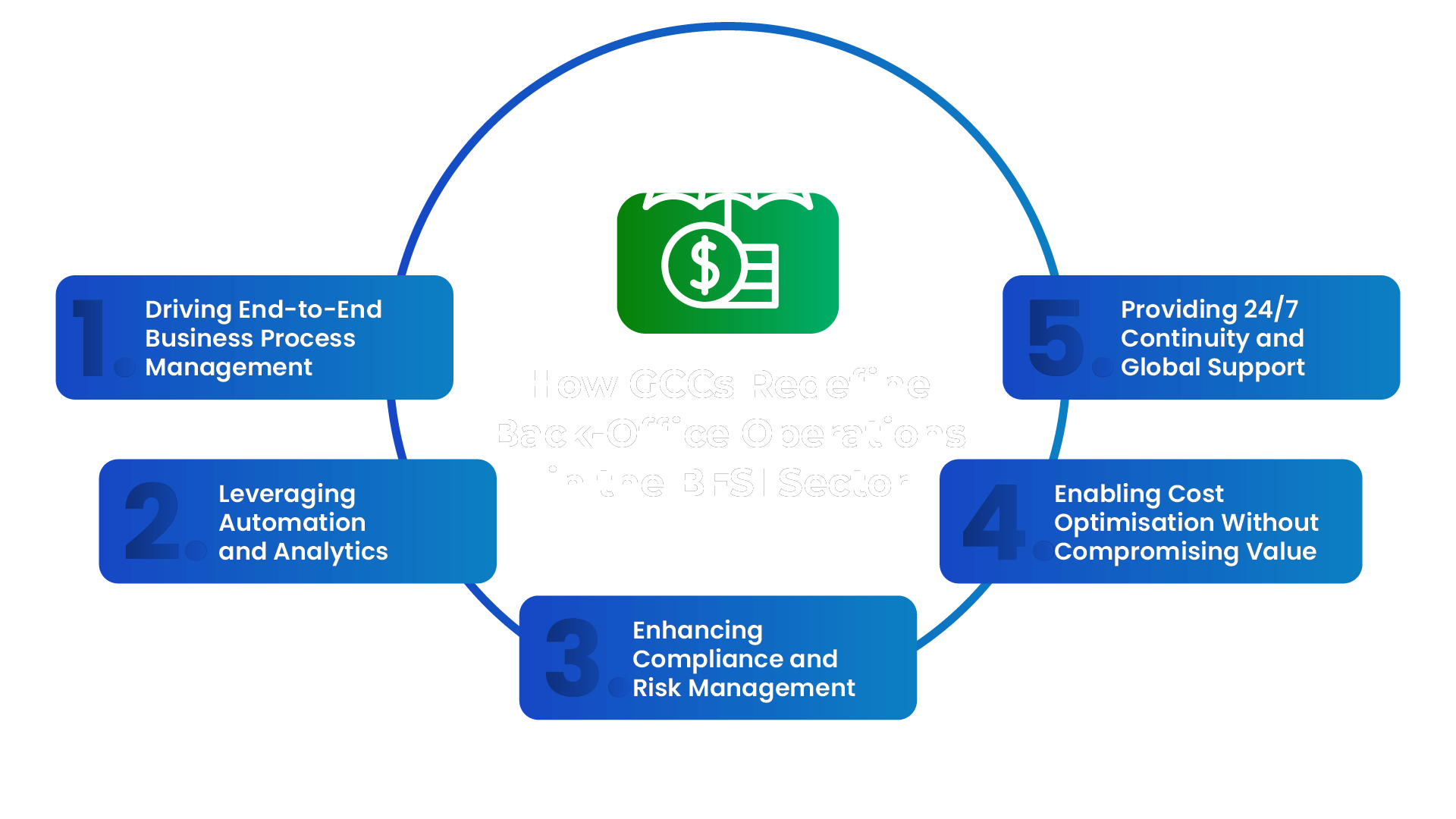

How GCCs Redefine Back-Office Operations in the BFSI Sector

1. Driving End-to-End Business Process Management

GCCs implement structured BPM models to optimise transaction processing, reconciliations, compliance reporting, and customer servicing. This ensures financial institutions to focus on front-end innovation while maintaining error-free, and cost-efficient back-office operations.

2. Leveraging Automation and Analytics

By embedding RPA and advanced analytics, GCCs enhance decision-making and reduce manual intervention in repetitive tasks, such as claims processing, loan approvals, and fraud detection. This improves speed and accuracy and empowers institutions with predictive insights.

3. Enhancing Compliance and Risk Management

With complex global regulations, BFSI organisations rely on GCCs to ensure robust governance frameworks, audit trails, and transparent dashboards. This proactive approach to compliance reduces risk exposure and protects brand reputation.

4. Providing 24/7 Continuity and Global Support

As round-the-clock service hubs, GCCs deliver seamless support to banking and financial services institutions across multiple markets. This ensures consistent service delivery, regardless of geography.

5. Enabling Cost Optimisation Without Compromising Value

Unlike traditional outsourcing models, GCCs offer strategic cost efficiencies by aligning process improvements with long-term business goals,=ensuring measurable impact beyond cost savings.

Why GCCs Are the Future of BFSI Back-Office Strategy

The BFSI sector is shifting from reactive back-office management to proactive, insight-driven operations. GCCs unite people, process, and technology in a unified model that supports business continuity while driving innovation at scale.

Banks and financial institutions that embrace GCC-led transformation stand to gain:

- Faster product rollouts

- Improved customer experience

- Reduced operational risks

- Future-ready operating models

Partner with IMS GBS for Future-Ready BFSI GCC Transformation

At IMS GBS, we help global enterprises to establish and scale their Global Capability Centres (GCCs) with a strong foundation in BPM, compliance, and digital transformation. Our bespoke solutions ensure every back-office operation is future-ready, secure, and aligned with strategic growth.